Healthcare IT Integration Market by Product (Interface Engine, Medical Device Integration, Media Integration), Service (Integration, Maintenance, Training, Consulting), End User (Hospital, Laboratories, Home Healthcare, Clinic) & Region - Global Forecast to 2026

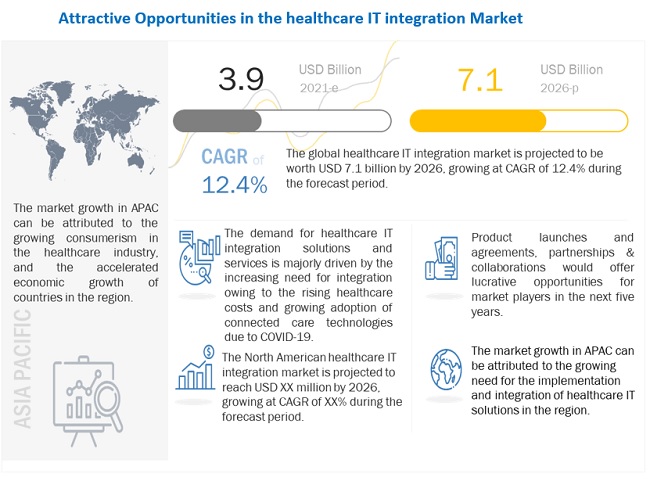

The global healthcare IT integration market in terms of revenue was estimated to be worth $3.9 billion in 2021 and is poised to reach $7.1 billion by 2026, growing at a CAGR of 12.4% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The global market is primarily driven by the substantial cost savings achieved through data integration in the healthcare industry, the increased use of connected care technologies during the COVID-19 pandemic, the rapid adoption of electronic health records and other healthcare IT solutions, the urgent need to integrate patient data into healthcare systems, and favourable government policies, funding programs, and initiatives to deploy healthcare IT integration solutions. However, interoperability issues and the high cost associated with healthcare IT integration solutions limit the overall adoption of these solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare IT Integration Market Dynamics

Driver: Rapid adoption of electronic health records and other healthcare IT solutions

Patient data is complex, confidential, and often unstructured. Merging this information into the healthcare delivery process is a challenge, which has to be addressed to realize opportunities for improved patient care. Although EHRs have been in use for more than a decade, the market has picked up pace recently due to government initiatives in various countries to improve patient data security. For example, in the US, the Health Information Technology for Economic and Clinical Health (HITECH) Act—enacted under the American Recovery and Reinvestment Act (ARRA)—allocated funding for incentivizing hospitals and physicians who demonstrate the meaningful use of EHRs. The regulatory requirements laid under HITECH have boosted the adoption of EHRs and EMRs. Another important consideration in the country is the rising number of accountable care organizations (ACOs), which increases the need for EHRs and EMRs. Government initiatives in other countries such as Denmark, Sweden, France, and Canada are also encouraging the adoption of EHRs and mandating their meaningful use for controlling the increasing healthcare costs and improving the quality of patient care.

Moreover, IT services help integrate various end users in the entire healthcare system, including hospitals, nursing care units, pharmacies, and medical insurance companies. However, integrating this data and making it available in real-time are essential factors for healthcare professionals to ensure effective decision-making. Thus, with the anticipated market growth of EHR systems in the coming years, hospitals will strongly focus on building their capabilities through integrating various hospital systems with EHR, thereby creating growth opportunities for the global market.

Restraint: Interoperability Issues

The heterogeneity of health information systems poses key challenges for the successful implementation and utilization of healthcare IT solutions. Many countries lack specific IT standards for data storage and exchange, leading to interoperability issues. Although various data storage, transportation, and safety standards are in place, implementing and integrating these interoperability standards is a major challenge for healthcare providers and healthcare IT solution vendors. Due to the absence of a single health information system that helps address all the administrative, clinical, technical, and laboratory requirements of large healthcare providers, the requirement for interoperability and interoperability standards has become critical.

Vendors also follow different data formats and standards owing to the poor knowledge or lack of technical know-how of defined standards, making it difficult to share real-time data with partner systems, which increases the cost of healthcare IT integration. Data quality and integrity issues, a lack of compliance with defined standards, a shortage of skilled professionals, and operational time differences between entities providing healthcare services are major obstacles to implementing completely interoperable healthcare IT infrastructure.

Opportunity: Growing demand for telehealth services and remote patient monitoring solutions

Currently, telehealth services are in demand for monitoring and consultation purposes. Advancements in healthcare solutions have made it possible to deliver educational content and ensure uninterrupted communication between patients and healthcare providers. The smooth functioning of remote patient monitoring solutions depends on the successful integration of medical devices and ICT, which helps deliver healthcare services over long distances. As doctors and nurses spend the majority of their working time away from computers in hospitals, it is difficult for them to carry patient records on the go. Therefore, many market players started providing mobile platforms, such as mobile applications, for healthcare IT solutions. In Europe, in July 2020, a study conducted by HIMSS and Siemens Healthineers revealed that 93% of health facilities had adopted at least one type of telehealth service or solution just before the COVID-19 outbreak.

Advancements in IT have provided an ever-expanding array of options such as advanced broadband networks, mobile devices and networks, remote patient monitoring, high-definition video conferencing, and EHRs. This has created significant opportunities for vendors of healthcare IT integration solutions. Through an IoT healthcare network comprising connected medical devices, patients sitting at their homes can be monitored remotely for their vital signs, such as blood pressure levels, weight, glucose levels, ECG, and body temperature, as patient data is automatically sent to a nurse or a physician.

The COVID-19 outbreak has further increased the demand for telehealth services and remote patient monitoring solutions. Various market players such as Epic Systems Corporation (US), Cerner Corporation (US), and Allscripts Healthcare (US) are also focused on integrating their EHR platforms with telehealth solutions to ease and promote virtual patient visits. For instance, Epic Systems helped set up telehealth solutions and provide training to clinicians in more than 200 hospitals and health systems. Similarly, Allscripts implemented telehealth solutions through its EHR patient engagement platform, which helps its clients to access virtual care services. Cerner Corporation has also integrated its EHR platform with telehealth capabilities, which helps improve patient access to healthcare from home.

A connected health environment allows physicians to monitor and regulate a patient’s condition at a distance. Connected health technologies involve smart sensing technologies, high-end connectivity, improvements in interfaces, and data analytics. These advancements help reduce healthcare costs by improving patient acceptance and minimizing repeated clinical visits. Furthermore, although implementation costs may be high, such technologies help expedite operations for many firms. With technological advancements, these solutions are playing a major role in improving remote monitoring and patient compliance, and subsequently, their quality of life. Thus, the growing demand for remote monitoring solutions and telehealth devices is expected to offer lucrative opportunities for the providers of healthcare IT integration solutions in the coming years.

Challenge: Data integration challenges

The healthcare industry is highly information-intensive, wherein patient information is generated in all departments at all points of care within the healthcare organization. However, generating credible information by integrating huge volumes of data plays a pivotal role in creating exhaustive and accurate patient records. Since various medical devices and diagnostic tools are being used within healthcare systems, there is a greater need to integrate all these systems to aid a timely response by healthcare professionals at different care delivery points.

Many healthcare organizations have invested in a variety of information management applications, such as imaging systems, email management systems, database management systems, forms management systems, clinical information systems, workforce management systems, asset management systems, content management systems, revenue cycle management systems, clinical and non-clinical workflow systems, and customer relations management systems. As healthcare organizations are increasingly adopting various healthcare IT systems, there is a greater need to integrate different types of IT systems into the IT architecture of the organization to ensure the optimum utilization of these systems and aid in accurate decision-making. The successful integration of healthcare IT systems with other systems is a focus of IT infrastructure development projects in healthcare organizations.

The Services segment accounted for the largest share of the healthcare IT integration market

The services segment accounted for a larger market share (60.8%) of the global market. Services account for a larger size of the healthcare IT integration solutions market owing to their indispensability. Healthcare professionals rely heavily on service providers for consulting, data storage, installation, training, maintenance, and regular technology upgrades. The products segment is expected to exhibit the highest CAGR of 12.7% during the forecast period. The rising adoption of healthcare IT integration solutions for simplifying the workflow of healthcare organizations; the growing need for data standardization; and the surging requirement to build, design, and implement standardized, interoperable networking platforms are likely to accelerate the growth of the healthcare IT integration services market during the forecast period.

The interface/integration engines segment accounted for the largest share of the global healthcare IT integration market.

The global market for products is classified into interface/integration engines, medical device integration software, media integration solutions, and other integration tools. Interface/integration engines accounted for the largest share (73.1%) of the healthcare IT integration products market. The growth of the market for interface engines can be attributed to the increasing need for information exchange within healthcare service provider facilities and with other affiliated organizations. However, the medical device integration solutions segment is expected to witness the highest CAGR of 13.3% during the forecast period. Factors such as the increasing adoption of EHR systems and other interoperability solutions in healthcare organizations, a growing number of regulatory requirements and healthcare reforms, the rising preference for home care settings, and the surging need to integrated healthcare systems to improve healthcare quality and outcomes are propelling the growth of the medical device integration software market.

The support and maintenance services segment accounted for the largest share of the global healthcare IT integration market.

The global market for services is segmented into implementation and integration services, support and maintenance services, training and education services, and consulting services. Support and maintenance services accounted for the largest share (56.0%) of the global market for services. Support and maintenance services take care of interoperability and software complexity issues. These services ensure that clients (healthcare providers) obtain access to the vendor company’s technical knowledge base, gain support from its product support team, and acquire application management skills.

The Hospitals segment accounted for the largest share of the global healthcare IT integration market.

Based on end user, the global market is categorized into hospitals, laboratories, clinics, diagnostic imaging centres, and other end users (telehealth service providers, pharmacies, home healthcare companies, nursing homes, and long-term care centers). Hospitals accounted for the largest share (71.8%) of the global market. The large share of this segment is primarily attributed to the rising use of healthcare IT integration solutions in hospitals to maximize value-based reimbursements and the increasing adoption of medical device integration solutions to reduce medical errors and improve care quality and patient safety.

North America was the largest regional market for healthcare IT Integration market

The global market is segmented into five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa. North America accounted for the largest share (57.2%) of the global market, followed by Europe (22.9%). Factors such as the widespread adoption of clinical device connectivity and interoperability solutions to curtail the rising healthcare costs, the increasing number of coronavirus (COVID-19) patients in the US, and stringent regulations and guidelines imposed by various government and non-government authorities such as the Federal Communications Commission (FCC)and the Centres for Medicare and Medicaid Services (CMS) are driving the growth of the healthcare IT integration solutions in North America.

To know about the assumptions considered for the study, download the pdf brochure

Prominent Key players in the healthcare IT integration market are Infor (US), InterSystems Corporation (US), Cerner Corporation (US), Orion Health (New Zealand), NextGen Healthcare, Inc. (US), iNTERFACEWARE, Inc. (Canada), Allscripts Healthcare Solutions, Inc. (US), Epic Systems Corporation (US), AVI-SPL, Inc. (US), Corepoint Health (Lyniate) (US), and Oracle Corporation (US).

Healthcare IT Integration Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$3.9 billion |

|

Projected revenue by 2026 |

$7.1 billion |

|

Growth Rate |

Poised to grow at a CAGR of 12.4% |

|

Market Driver |

Rapid adoption of electronic health records and other healthcare IT solutions |

|

Market Opportunity |

Growing demand for telehealth services and remote patient monitoring solutions |

The research report categorizes the Healthcare IT integration market to forecast revenue and analyze trends in each of the following submarkets:

By Products & Services

-

Products

- Interface/Integration Engines

- Medica Device Integration Software

- Media Integration Software

- Other Integration Tools

- Services

- Support and maintenance Services

-

Implementation and Integration Services

- Training and Education Services

- Consulting Services

By End User

- Hospitals

- Laboratories

- Clinics

- Diagnostic Imaging Centres

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In September 2021 Lyniate (US) launched Lyniate Rapid -a healthcare API gateway and manager designed to help health teams create and safeguard APIs, including Fast Healthcare Interoperability Resources (FHIR)-based APIs.

- In April 2021, Lyniate (US) acquired Datica, Inc.(US). The acquisition of Datica Integration Business (from Datica, Inc.) has extended the ability of its customers to connect and aggregate the data from multiple systems of record through FHIR.

- In January 2021 Koninklijke Philips N.V. (Netherlands) signed an agreement with Capsule Technologies Inc. (US) aiming to acquire Capsule Technologies, Inc. under its Connected Care segment, to expand its product offering in the segment.

- In February 2020, Allscripts Healthcare Solutions (US) partnered with Manorama Infosolutions (India) Under this partnership, Allscripts will provide an integrated healthcare management system and health information exchange platform in India. This partnership will enable Allscripts to expand its geographic reach in India.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare IT integration market?

The global healthcare IT integration market boasts a total revenue value of $7.1 billion by 2026.

What is the estimated growth rate (CAGR) of the global healthcare IT integration market?

The global market for healthcare IT integration has an estimated compound annual growth rate (CAGR) of 12.4% and a revenue size in the region of $3.9 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HEALTHCARE IT INTEGRATION MARKET

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZING & VALIDATION APPROACH

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 TOP-DOWN APPROACH

FIGURE 9 CAGR PROJECTIONS: OVERALL GLOBAL MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE/RANKING ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: GLOBAL MARKET

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 11 HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT AND SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHIC SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 HEALTHCARE IT INTEGRATION MARKET OVERVIEW

FIGURE 16 SUBSTANTIAL COST SAVING ACHIEVED THROUGH DATA INTEGRATION IN HEALTHCARE INDUSTRY AND INCREASED USE OF CONNECTED CARE TECHNOLOGIES DURING COVID-19 PANDEMIC ARE EXPECTED TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY END USER AND COUNTRY (2020)

FIGURE 17 HOSPITALS COMMANDED NORTH AMERICAN MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL MARKET (2021–2026)

FIGURE 19 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD (2021–2026)

4.5 GLOBAL MARKET: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES COMPARED TO DEVELOPED MARKETS DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 HEALTHCARE IT INTEGRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Substantial cost saving achieved through data integration in healthcare industry

FIGURE 22 HEALTHCARE SPENDING PER CAPITA, 2018 (USD)

FIGURE 23 GLOBAL ANNUAL HEALTHCARE EXPENDITURE: DEVELOPED VS. DEVELOPING ECONOMIES (1995 VS. 2012 VS. 2022)

5.2.1.2 Increased use of connected care technologies during COVID-19 pandemic

5.2.1.3 Rapid adoption of electronic health records and other healthcare IT solutions

5.2.1.4 Favorable government policies, funding programs, and initiatives to deploy healthcare IT integration solutions

5.2.1.5 Urgent need to integrate patient data into healthcare systems

5.2.2 RESTRAINTS

5.2.2.1 Interoperability issues

5.2.2.2 High cost associated with healthcare IT integration solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for telehealth services and remote patient monitoring solutions

5.2.3.2 Emerging market for healthcare IT integration solutions in developing countries

5.2.4 CHALLENGES

5.2.4.1 Data integration challenges

5.2.4.2 Data security concerns

5.2.4.3 Shortage of skilled healthcare IT professionals

6 INDUSTRY INSIGHTS (Page No. - 62)

6.1 INDUSTRY TRENDS

6.1.1 FAST HEALTHCARE INTEROPERABILITY RESOURCES

6.1.2 GROWING NEED FOR SEMANTIC INTEROPERABILITY

6.1.3 TRANSITION OF POINT OF CARE DIAGNOSTICS FROM HOSPITALS TO HOME SETTINGS

6.1.4 MEDICAL DEVICE DATA INTEGRATION INTO CARE DELIVERY PROCESSES

6.1.5 INCREASING ADOPTION OF APPLICATION PROGRAMMING INTERFACE

6.2 INTEROPERABILITY STANDARDS

TABLE 2 KEY STANDARDS FOR INTEROPERABILITY IN DIGITAL HEALTH SPECTRUM

TABLE 3 QUALITATIVE ANALYSIS OF WIDELY USED DATA TRANSMISSION STANDARDS IN DIGITAL HEALTH SPECTRUM

6.3 IMPACT OF COVID-19 ON GLOBAL MARKET

FIGURE 24 IMPACT OF COVID-19 ON GLOBAL MARKET

6.4 PRODUCT PORTFOLIO ANALYSIS

TABLE 4 PRODUCT PORTFOLIO ANALYSIS: HEALTHCARE IT INTEGRATION PRODUCTS MARKET

6.5 HCIT EXPENDITURE

6.5.1 NORTH AMERICA

TABLE 5 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

6.5.2 EUROPE

6.5.3 ASIA PACIFIC

TABLE 6 JAPAN: HEALTHCARE IT INITIATIVES AND FUNDING

TABLE 7 CHINA: HEALTHCARE IT INITIATIVES AND FUNDING

6.6 ADOPTION TRENDS

6.6.1 NORTH AMERICA: HEALTHCARE IT SOLUTION ADOPTION TRENDS

TABLE 8 US: INPATIENT EMR ADOPTION MODEL (EMRAM), 2017

FIGURE 25 US: ADOPTION OF EHR SYSTEMS IN HOSPITALS (2007–2018)

FIGURE 26 US: OUTPATIENT EMR ADOPTION, Q2 2017

6.6.2 EUROPE: ADOPTION TRENDS

FIGURE 27 EUROPE: EHEALTH PRIORITIES IN HEALTH FACILITIES, 2019

TABLE 9 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY

FIGURE 28 EUROPE: EHEALTH CHALLENGES FACED BY HEALTHCARE PROVIDERS, 2019

6.6.3 ASIA PACIFIC: ADOPTION TRENDS

6.6.4 REST OF THE WORLD: ADOPTION TRENDS

6.7 PRICING ANALYSIS

TABLE 10 PRICING MODEL: HEALTHCARE IT INTEGRATION SOLUTIONS

6.8 REGULATORY ANALYSIS

TABLE 11 KEY REGULATIONS & STANDARDS GOVERNING HEALTHCARE IT INTEGRATION TECHNOLOGIES GLOBALLY

6.9 TECHNOLOGY ANALYSIS

6.9.1 MACHINE LEARNING

6.9.2 ARTIFICIAL INTELLIGENCE

6.9.3 INTERNET OF THINGS

6.9.4 BLOCKCHAIN

6.9.5 AUGMENTED REALITY

6.10 POTENTIAL HEALTHCARE IT TECHNOLOGIES

6.10.1 AI PLATFORMS

6.10.2 APP-ENABLED PATIENT PORTALS

6.11 ECOSYSTEM ANALYSIS

6.11.1 HEALTHCARE IT MARKET: ECOSYSTEM ANALYSIS

6.11.2 GLOBAL MARKET: ECOSYSTEM ANALYSIS

7 HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE (Page No. - 87)

7.1 INTRODUCTION

TABLE 12 GLOBAL MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

7.2 SERVICES

TABLE 13 GLOBAL MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 GLOBAL MARKET FOR SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 SUPPORT & MAINTENANCE SERVICES

7.2.1.1 Support and maintenance services help establish interface control and evaluate performance of each interface in healthcare IT products

TABLE 15 SUPPORT & MAINTENANCE SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 16 GLOBAL MARKET FOR SUPPORT & MAINTENANCE SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 IMPLEMENTATION & INTEGRATION SERVICES

7.2.2.1 Implementation and integration services ensure compliance of healthcare IT products with regulatory standards and guarantee software interoperability

TABLE 17 IMPLEMENTATION & INTEGRATION SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 18 GLOBAL MARKET FOR IMPLEMENTATION & INTEGRATION SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 TRAINING & EDUCATION SERVICES

7.2.3.1 Training and education services increase healthcare providers’ awareness of latest healthcare IT integration products

TABLE 19 TRAINING & EDUCATION SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 20 GLOBAL MARKET FOR TRAINING & EDUCATION SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 CONSULTING SERVICES

7.2.4.1 Consulting services deliver optimum guidance to healthcare providers on integration solutions

TABLE 21 CONSULTING SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 22 GLOBAL MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 PRODUCTS

TABLE 23 GLOBAL MARKET FOR PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 24 GLOBAL MARKET FOR PRODUCTS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 INTERFACE/INTEGRATION ENGINES

7.3.1.1 Integration engines help develop data interfaces quickly

TABLE 25 INTERFACE/INTEGRATION ENGINES OFFERED BY KEY MARKET PLAYERS

TABLE 26 GLOBAL MARKET FOR INTERFACE/INTEGRATION ENGINES, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

7.3.2.1 Preference for home healthcare services during COVID-19 era accelerated demand for medical device integration software

TABLE 27 MEDICAL DEVICE INTEGRATION SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 28 HEALTHCARE IT MARKET FOR MEDICAL DEVICE INTEGRATION SOFTWARE, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 MEDIA INTEGRATION SOLUTIONS

7.3.3.1 Increased adoption of telehealth solutions after deadly outbreak of COVID-19 to stimulate need for media integration solutions

TABLE 29 MEDIA INTEGRATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 30 HEALTHCARE IT MARKET FOR MEDIA INTEGRATION SOLUTIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 OTHER INTEGRATION TOOLS

TABLE 31 OTHER INTEGRATION TOOLS OFFERED BY KEY MARKET PLAYERS

TABLE 32 GLOBAL MARKET FOR OTHER INTEGRATION TOOLS, BY COUNTRY, 2019–2026 (USD MILLION)

8 HEALTHCARE IT INTEGRATION MARKET, BY END USER (Page No. - 106)

8.1 INTRODUCTION

TABLE 33 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 HOSPITALS

8.2.1 HIGH PURCHASING POWER FACILITATES HOSPITALS TO ADOPT HEALTHCARE IT INTEGRATION SOLUTIONS

TABLE 34 GLOBAL MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 LABORATORIES

8.3.1 HEALTHCARE IT INTEGRATION SOLUTIONS HELP LABORATORIES IMPROVE WORKFLOW AND MINIMIZE ERROR OCCURRENCE

TABLE 35 GLOBAL MARKET FOR LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 CLINICS

8.4.1 STRONG NEED TO EXCHANGE PATIENT INFORMATION ACROSS DIFFERENT HEALTHCARE FACILITIES TO SUPPORT MARKET GROWTH

TABLE 36 GLOBAL MARKET FOR CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 DIAGNOSTIC IMAGING CENTERS

8.5.1 HIGH VOLUME OF CLINICAL DATA AND INCREASED NEED TO STREAMLINE DATA WORKFLOW BETWEEN IMAGING CENTERS TO SPUR DEMAND FOR INTEGRATION SOLUTIONS

TABLE 37 GLOBAL MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 OTHER END USERS

TABLE 38 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 HEALTHCARE IT INTEGRATION MARKET, BY REGION (Page No. - 114)

9.1 INTRODUCTION

TABLE 39 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: HEALTHCARE IT INTEGRATION MARKET SNAPSHOT

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET FOR PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Highest healthcare expenditure of US among OECD nations allows country to dominate North American market

FIGURE 30 US: HOSPITAL EHR ADOPTION (2007–2018)

FIGURE 31 HOSPITAL ROUTINE ELECTRONIC NOTIFICATION

TABLE 45 US: KEY MACROINDICATORS

TABLE 46 US: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 47 US: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 US: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Strong government support to develop healthcare infrastructure would propel market growth

TABLE 50 CANADA: FUNDING AND GRANTS FOR HCIT INTEGRATION

TABLE 51 CANADA: KEY MACROINDICATORS

TABLE 52 CANADA: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 53 CANADA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 CANADA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 56 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 High adoption of EHR systems among primary care physicians is major factor driving market growth

TABLE 61 GERMANY: KEY MACROINDICATORS

TABLE 62 GERMANY: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 63 GERMANY: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 GERMANY: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Government initiatives will drive adoption of healthcare IT integration solutions in UK

TABLE 66 UK: KEY MACROINDICATORS

TABLE 67 UK: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 68 UK: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 UK: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Favorable government initiatives to spur demand for healthcare IT integration solutions

TABLE 71 FRANCE: KEY MACROINDICATORS

TABLE 72 FRANCE: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 73 FRANCE: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 FRANCE: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 76 ROE: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 77 ROE: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 ROE: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

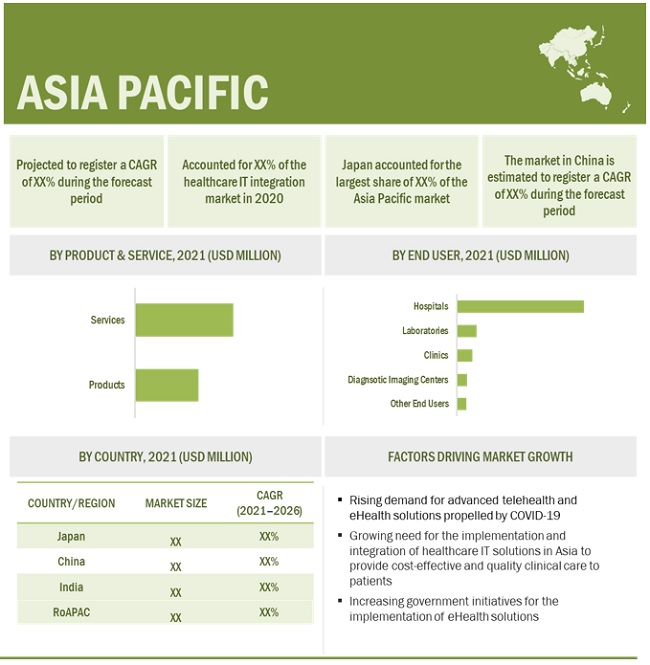

9.4 ASIA PACIFIC

FIGURE 32 APAC: HEALTHCARE IT INTEGRATION MARKET SNAPSHOT

TABLE 80 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 APAC: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 82 APAC: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 APAC: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan is largest market in APAC

TABLE 85 JAPAN: KEY MACROINDICATORS

TABLE 86 JAPAN: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 87 JAPAN: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 JAPAN: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Large patient pool due to COVID-19 pandemic to stimulate adoption of healthcare IT integration solutions in China

TABLE 90 CHINA: KEY MACROINDICATORS

TABLE 91 CHINA: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 92 CHINA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 CHINA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increased need for cost-effective medical technologies resulted in high adoption of healthcare IT integration solutions in India

TABLE 95 INDIA: KEY MACROINDICATORS

TABLE 96 INDIA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 97 INDIA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 INDIA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 100 ROAPAC: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 101 ROAPAC: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 ROAPAC: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

TABLE 104 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 106 LATIN AMERICA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 LATIN AMERICA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.2 BRAZIL

9.5.2.1 Developments in healthcare infrastructure to support market growth in Brazil

TABLE 109 BRAZIL: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 110 BRAZIL: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 BRAZIL: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 BRAZIL: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.3 MEXICO

9.5.3.1 Government expenditure toward healthcare digitization has resulted in increased deployment of healthcare IT integration solutions

TABLE 113 MEXICO: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 114 MEXICO: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 MEXICO: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 MEXICO: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.4 REST OF LATIN AMERICA

TABLE 117 ROLA: HEALTHCARE IT INTEGRATION MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 118 ROLA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ROLA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 ROLA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 RISING GOVERNMENT SUPPORT AND FUNDING FOR COVID-19 RESEARCH TO DRIVE MARKET GROWTH

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: HEALTHCARE IT INTEGRATION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: HEALTHCARE IT INTEGRATION PRODUCTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 165)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN HEALTHCARE IT INTEGRATION MARKET

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN GLOBAL MARKET

10.4 COMPETITIVE BENCHMARKING

TABLE 125 FOOTPRINT OF COMPANIES IN GLOBAL MARKET

TABLE 126 PRODUCT AND SERVICE: COMPANY FOOTPRINT (25 COMPANIES)

TABLE 127 END USER: COMPANY FOOTPRINT (25 COMPANIES)

TABLE 128 REGION: COMPANY FOOTPRINT (26 COMPANIES)

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE PLAYER

10.5.4 PARTICIPANT

FIGURE 34 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

10.6 COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES

10.6.1 PROGRESSIVE COMPANY

10.6.2 DYNAMIC COMPANY

10.6.3 STARTING BLOCK

10.6.4 RESPONSIVE COMPANY

FIGURE 35 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2020)

10.7 MARKET SHARE ANALYSIS

10.7.1 HEALTHCARE IT INTERFACE/INTEGRATION ENGINES

FIGURE 36 HEALTHCARE IT INTERFACE/INTEGRATION ENGINES MARKET RANKING ANALYSIS, BY PLAYER, 2020

10.7.2 MEDICAL DEVICE INTEGRATION SOFTWARE

FIGURE 37 MEDICAL DEVICE INTEGRATION SOFTWARE MARKET SHARE ANALYSIS, BY PLAYER, 2020

10.7.3 MEDIA INTEGRATION SOLUTIONS

FIGURE 38 MEDIA INTEGRATION SOLUTIONS MARKET RANKING ANALYSIS, BY PLAYER, 2020

10.8 COMPETITIVE SCENARIO

TABLE 129 PRODUCT & SERVICE LAUNCHES AND APPROVALS, 2018–2021

TABLE 130 DEALS, 2018–2021

11 COMPANY PROFILES (Page No. - 181)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 CERNER CORPORATION

TABLE 131 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 39 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.2 CAPSULE TECHNOLOGIES, INC.

TABLE 132 CAPSULE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

11.1.3 INFOR (KOCH INDUSTRIES)

TABLE 133 INFOR: BUSINESS OVERVIEW

FIGURE 40 INFOR: COMPANY SNAPSHOT (2019)

11.1.4 LYNIATE

TABLE 134 LYNIATE: BUSINESS OVERVIEW

11.1.5 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

TABLE 135 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 41 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2020)

11.1.6 EPIC SYSTEMS CORPORATION

TABLE 136 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

11.1.7 KONINKLIJKE PHILIPS N.V.

TABLE 137 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 42 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

11.1.8 GE HEALTHCARE

TABLE 138 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2020)

11.1.9 INTERSYSTEMS CORPORATION

TABLE 139 INTERSYSTEMS CORPORATION: BUSINESS OVERVIEW

11.1.10 COGNIZANT

TABLE 140 COGNIZANT: BUSINESS OVERVIEW

FIGURE 44 COGNIZANT: COMPANY SNAPSHOT (2020)

11.1.11 CHANGE HEALTHCARE

TABLE 141 CHANGE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 45 CHANGE HEALTHCARE: COMPANY SNAPSHOT (2021)

11.1.12 ORION HEALTH GROUP LIMITED

TABLE 142 ORION HEALTH GROUP LIMITED: BUSINESS OVERVIEW

FIGURE 46 ORION HEALTH GROUP LIMITED: COMPANY SNAPSHOT (2020)

11.1.13 SUMMIT HEALTHCARE SERVICES, INC.

TABLE 143 SUMMIT HEALTHCARE SERVICES, INC.: BUSINESS OVERVIEW

11.1.14 MEDICAL INFORMATION TECHNOLOGY, INC.

TABLE 144 MEDICAL INFORMATION TECHNOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 47 MEDITECH: COMPANY SNAPSHOT (2019)

11.1.15 NEXTGEN HEALTHCARE, INC.

TABLE 145 NEXTGEN HEALTHCARE, INC.: BUSINESS OVERVIEW

FIGURE 48 NEXTGEN HEALTHCARE, INC.: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 IBM

11.2.2 ORACLE CORPORATION

11.2.3 SIEMENS HEALTHINEERS

11.2.4 REDOX, INC.

11.2.5 OSPLABS

11.2.6 AVI-SPL, INC.

11.2.7 INTERFACEWARE INC.

11.2.8 ATHENAHEALTH

11.2.9 WIPRO, LTD.

11.2.10 INOVALON

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 225)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

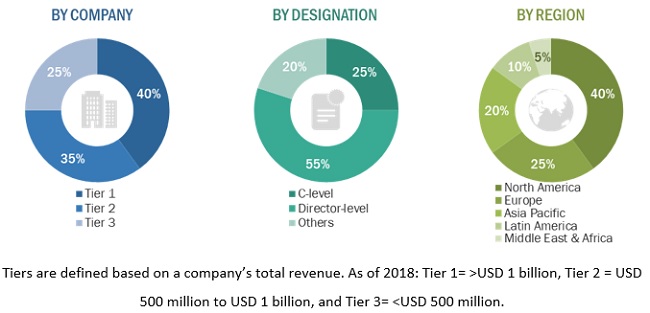

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare IT integration market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Healthcare IT integration market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the healthcare IT integration market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the global market

The size of the global market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global healthcare IT integration market by product and service, end user, and region, in terms of value

- To forecast the size of the global market with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape

- To profile key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, collaborations, mergers, product/technology developments, and R&D activities of leading players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe market into Italy, Spain, Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of Latin America market into the Argentina, Peru, Columbia, Ecuador, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare IT Integration Market